I have learned recently from @treasurer that if you can calculate the actual value of a membership (e.g. total discounts given to the member) you can deduct that from the membership cost and claim gift-aid on the balance.

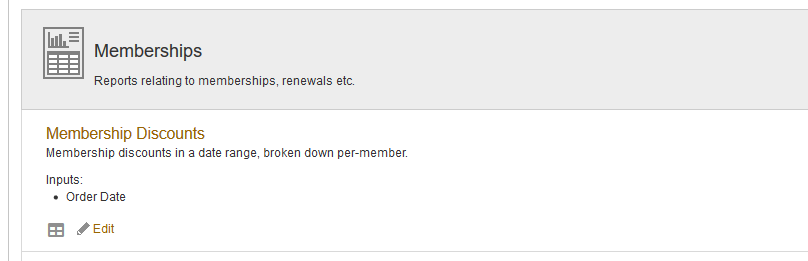

So there’s now a new report which shows the discount value given to each member in a date range. , broken down by member. Anyone with a membership scheme that might be eligible, take note!

There is a Statutory Concession called the split payment rule whereby charities are allowed to deduct the value of the benefit from the donation and claim gift aid on the balance. In a case like ours this is very beneficial as buying just a couple of tickets gives a discount of more than 25% of the cost of the membership. As part of the latest changes the government has announced that it intends to bring this and other concessions into the legislation. See the following link: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/683116/Simplifying_the_Gift_Aid_donor_benefits_rules-further_consultation_-_summary_of_responses.pdf. The relevant bits are 3.1 on page 8 and Annex B.